Opportunities and challenges

Nuclear medicine

The African Medical Centre of Excellence (AMCE) plans to establish a cyclotron facility in Abuja, Nigeria, to improve diagnostics and treatment for chronic as well as complex diseases. This facility will enable precise disease detection using medical isotopes, with an initial focus on cancer, sickle cell disease, cardiovascular issues, and blood disorders.

Brian Deaver, CEO of AMCE, said that the amenity will help produce radiopharmaceuticals locally and reduce dependence on external organisations. Currently, West Africa lacks dedicated cyclotron units, with only one facility covering the entire region. According to the International Atomic Energy Agency (IAEA), most cyclotrons are concentrated in North and South Africa, forcing patients to travel long distances for advanced imaging services like PET-CT scans.

Costing USD 237 million, the facility’s first phase will serve as a regional hub, supplying medical isotopes to healthcare providers across West Africa. This initiative will reduce patient outflow to foreign nations, help retain skilled professionals as well as establish West Africa as a centre for nuclear medicine and medical tourism. The cyclotron facility is set to be completed in April 2025, with operations commencing by June.

Genomics/ precision medicine

African startups are increasingly tackling the critical underrepresentation of African genomic data in global medical research and drug development. Currently, approximately 90% of genetic material used in pharmaceutical research is derived from Caucasian sources, while African genetic material accounts for a mere 2%. This disparity severely limits the effectiveness of many pharmaceutical products for African populations.

African biotech firms seek to address this gap by expanding the representation of African genomes in pharmaceutical research. This will not only enhance drug development processes but also improve the efficacy of new medications for African individuals. These initiatives aim to create advanced diagnostic and risk assessment tests tailored to African genetic diversity, one of the most varied in the world. The African Medical Centre of Excellence (AMCE) has also entered the genomics field, partnering with King’s College London and pharmaceutical leader Novartis to locally produce genome-specific medicines in Nigeria. This collaboration aims to adapt treatment plans in line with African genetic profiles, furthering the development of precision medicine in the region.

Sustainable healthcare

Nigeria is at the forefront of sustainable healthcare in West Africa, with initiatives like the Rural Electrification Agency’s (REA) deployment of containerised 50kW solar hybrid systems across 100 healthcare centres in the first phase of the Nigeria Electrification Project. Phase two will extend to more than 400 primary healthcare facilities, significantly strengthening emergency healthcare services by powering critical care equipment such as ventilators and cold-chain storage for vaccines plus other temperature-sensitive pharmaceuticals.

Workforce constraints and AI

West Africa faces a substantial shortage of healthcare professionals. A survey by the World Health Organisation found that the ratio of health workers to the number of people is 1.55 per 1000 people in West Africa, well below its recommended threshold of 4.45. This poses a considerable challenge in delivering adequate healthcare services and highlights an urgent need for solutions that can ease the burden on existing medical personnel.

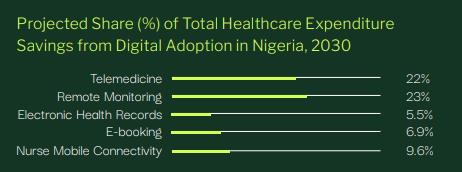

To this end, Nigerian startups are tapping the potential of AI to reduce the administrative workload on healthcare professionals. Tools like speech-to-text transcription software allow doctors, nurses, and lab technicians to concentrate on patient care, significantly enhancing productivity. With over 90% accuracy in recognising more than 200 African accents, such apps cut paperwork time to one-sixth, freeing up healthcare workers for essential duties. AI tools can be integrated with electronic health records (EHRs) and provide opportunities to expand their implementation across healthcare facilities and resolve one of the region’s most pressing challenges. African biotech firms seek to address this gap by expanding the representation of African genomes in pharmaceutical research. This will not only enhance drug development processes but also improve the efficacy of new medications for African individuals.